Rocky Hill’s current mayor, Lisa Marotta, has done a lot of explaining recently about why taxes have continued to rise under her administration. In an opinion article in the Rocky Hill Life Magazine, the mayor attributed the town’s property taxes increase, and cuts to the library and school programs to forces beyond her control, laying the blame on the state. In a recent debate, she also claimed that her administration’s 10-year tax abatement for the Kelson Row development was somehow a success for the town. Rocky Hill needs leadership that offers a sound strategy, not excuses. How can we stop our taxes from continuing to increase?

Allan Smith, the Democratic candidate for Mayor of Rocky Hill, believes in problem-solving and being action oriented. Allan is a small business owner who believes in creativity and collaboration, not complaining. Allan’s action plan if he were to become mayor includes the following initiatives so Rocky Hill moves forward in a new way:

- Exploring sharing services across departments and neighboring towns to save costs & increase efficiency. Allan’s approach would be partnering with neighboring towns by sharing certain services without losing local control. Shared services projects are a way to lower costs for certain town assets and resources not always being used (think seasonal street-sweepers and tree-trimming equipment). Our current mayor has touted their increased attention to shared services like partnering with Wethersfield to work on the Silas Deane, however, it was our neighboring towns who led these projects and brought Rocky Hill along. Allan is a mayoral candidate who wants to be first to the table to represent Rocky Hill. He already has relationships with the neighboring town leaders, so can join this effort quickly to try to lower Rocky Hill’s costs.

- Banding together with other mayors to argue for legislative change to the PILOT funding formula. PILOT is a state program that funds part of town’s property taxes because certain town properties aren’t required to pay taxes (for example, Dinosaur State Park). Mayor Marotta’s approach has been to write opinion pieces in local newspapers and testify at the state capitol complaining that PILOT funding is not increasing enough. Allan believes in doing, not complaining. Other towns are getting more money from their state (for example, Wethersfield getting $200+ million for 70% reimbursement toward new schools) because there is closer cooperation with their town and state representatives. Allan’s approach will be to have a unified front with Rocky Hill’s Representative Kerry Wood and State Senator Matt Lesser to identify projects and more effectively push for Rocky Hill to get its fair share of grants and PILOT funding.

- Change Rocky Hill’s tax base to “diversity revenue”. Diversity revenue means finding different ways for a town to receive income. As a certified commercial real estate agent, Allan understands what developers and property owners need to be successful. In the last town re-valuation, Rocky Hill’s residential property tax income had to be used for more of the town’s budget because more business offices are vacant and less valuable since 2018. We need someone on staff to exclusively help connect businesses with the town and streamline economic development. Allan would propose hiring a full-time business development manager to attract new businesses and fill vacancies.

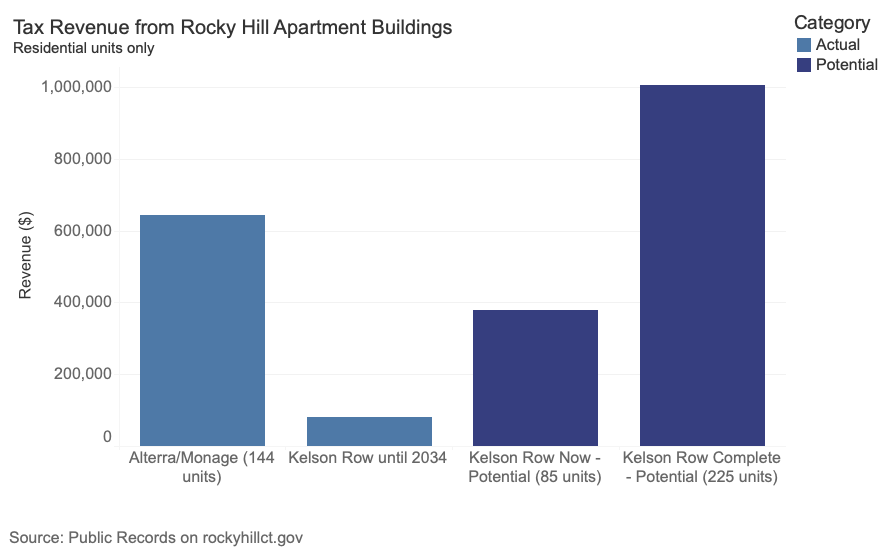

Regarding Kelson Row, in the recent Rocky Hill conversation event between Allan and Mayor Marotta, Allan pointed out that, because of the mayor’s tax reduction deal, Rocky Hill will lose more than $10 million dollars in tax revenue over the next 10 years or more. Further, if Kelson Row was being taxed for the full amount it owes, even with being partially completed, Rocky Hill could have avoided cuts to our schools, public safety, and library or shrunk the property tax increases in this year’s budget. Allan’s approach would have been a modest tax reduction to allow the developer to “get off the ground”, but only for a short period until they began collecting rents, and residents begin moving in and using town services.

Allan Smith believes it’s a mayor’s job to make sure the town gets the state funding it needs and tax income it deserves so it can evolve and thrive. Vote for Allan Smith if that’s where you want Rocky Hill to go from here!